What is bullion and why should you consider it for your investment portfolio? Bullion is precision-grade gold and silver, often synonymous with wealth and economic stability. Understanding bullion investment can be daunting for newcomers. Our guide distills the complexities, offering you a clear pathway through buying, selling, and maximizing your bullion investments, helping you secure your fiscal future with confidence.

Key Takeaways

- Bullion refers to gold and silver of at least 99.5% pure for gold and 99.9% for silver, used for investment, and comes in ‘parted’ (pure) and ‘unparted’ (mixed metals) forms.

- Gold and silver bullion continue to be important in global finance, with around 20% of mined gold held as reserves by central banks, serving as hedge assets and economic health indicators.

- The LBMA ensures quality standards and market integrity in global bullion trade, with the London Bullion Market facilitating major trades in precious metals.

The Essence of Bullion: Defining Gold and Silver Bars

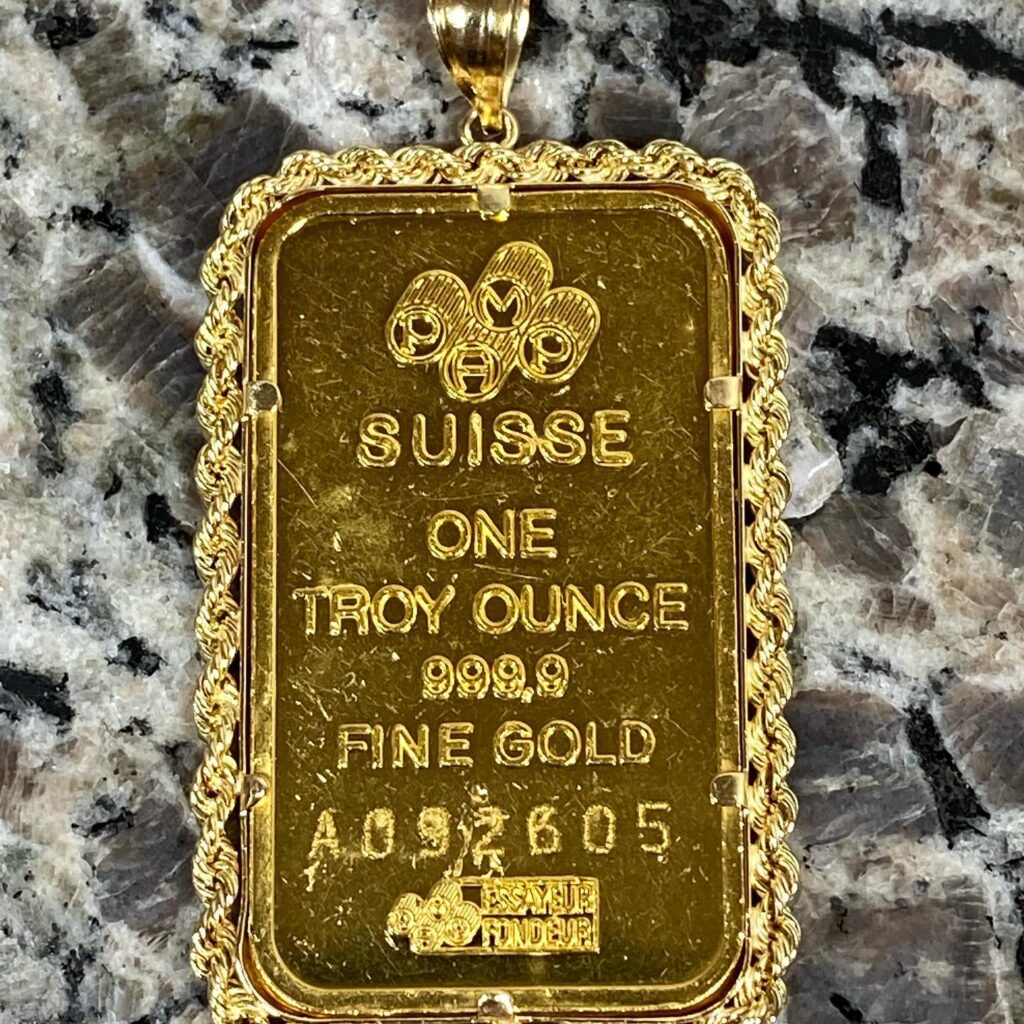

Embarking on the adventure of investing in precious metals requires a comprehensive grasp of what gold and silver actually are. Bullion is characterized by high-purity gold and silver, specifically tailored for investment purposes. Gold bullion demands no less than 99.5% purity, and silver bullion requires a minimum purity of 99.9%. These captivating elements often take shape as coins, bars or ingots. Their appeal derived from both inherent worth and versatility, which extends from exquisite jewelry to sophisticated technological uses.

For those venturing into investment opportunities within this sector, two main types of bullion are offered: ‘parted,’ which consists solely of pure gold or pure silver. And ‘unparted’, which contains a combination of different metals, but still maintains high levels required for classification as bullion. Catering to various investor strategies and preferences, these options provide ample choice for anyone interested in incorporating these valuable assets into their financial holdings. In contemplating our choices, we must ask ourselves: how do such gleaming treasures maintain their esteemed status?

The Role of Bullion in the Financial World

The importance of gold and silver bullion extends beyond their physical beauty, as they have been fundamental in establishing stability and confidence in international trade and currency. Following World War II, the Bretton Woods Agreement affirmed the U.S. dollar’s role as a dominant global reserve currency by fixing its value to gold, highlighting gold’s essential function within worldwide monetary affairs. When adhering to the gold standard, countries regularly settled account imbalances with actual pieces of precious metal. Emphasizing that paper currencies were once directly exchangeable for solid gold—and demonstrating how central these metals have been to fiscal structures.

In contemporary economic climates, silver and precious metals maintain their influence. Nearly 20% of all extracted gold can be found guarding national bank vaults across various nations. These reserves are multifaceted assets. They provide security against financial uncertainty and act as an indicator of a nation’s economic status. The United States holds Earth’s largest stockpile of this valuable commodity, which reinforces its continued reliance on it for financial resilience—a testament to our lasting dedication to using these elements as reliable sources of wealth protection. Given such rich heritage coupled with persistent relevance today, is what drives entities ranging from private individuals to large-scale establishments into amassing these commodities themselves. And when pondering where one might begin trading them? Lincoln Pawn offers insights into just that process.

Lincoln Pawn’s Venture into Precious Metals

Situated in the lively city of Anaheim, CA, Lincoln Pawn has distinguished itself as a trusted dealer in precious metals by diversifying its services to encompass both purchasing and selling gold and silver bullion. This initiative is focused on providing customers with a safe and efficient avenue for swiftly exchanging their assets into liquid cash or acquiring new investments, along with an official sale receipt acknowledging every transaction made.

Set at 2673 W Lincoln Ave, Anaheim, CA 92801, Lincoln Pawn stands out as a physical establishment where individuals can confidently engage in transactions involving gold and silver bullion. For those inclined towards virtual interactions, our company website acts as an accessible platform through which clients can browse our selection of gold and silver via search phone message options tailored for online convenience.

Buying Gold and Silver at Lincoln Pawn

When attracted by the allure of gold and silver’s luster, Lincoln Pawn presents a selection of coins and bullion that you can buy at prices reflecting their true market value. To facilitate your decision to acquire these valuable items, free quotes and evaluations are provided so you’re fully informed about their worth before making a purchase.

Completing this process is simple through a direct cash transaction, which allows quick gratification and immediate possession of precious metals. This dedication to clarity and simplicity extends to selling precious metals—another service where Lincoln Pawn exercises careful attention. There’s an option available for those who prefer online transactions. Once verification is successful, all that remains is waiting momentarily before finalizing your next order online.

Selling Your Precious Metals

Lincoln Pawn is committed to providing customers and dealers prepared to sell their precious metals with:

- Fair and competitive market pricing

- Quick and efficient transactions

- The highest possible payments for your assets

- An unparalleled customer experience

At Lincoln Pawn, whether you’re dealing with coins or bullion, we guarantee that the worth of your money and investment in precious metals is matched by an exceptional customer experience. This ensures our standing as a reliable merchant within the bullion trading sphere.

For most investors, including private individuals contemplating various routes for their bullion investments, Lincoln Pawn extends a range of options designed to meet their investment objectives.

Investment Avenues for Bullion Enthusiasts

Investors are drawn to the intrinsic allure of gold and silver bullion, captivated by both their tangible luster and their standing as reliable assets during periods of economic or geopolitical instability. They have numerous investment avenues available, from holding physical gold and silver to engaging with the ease offered by bullion ETFs or delving into futures trading in these precious metals. The diverse options each come with its specific factors for consideration, potential risks, and prospective gains that guide investors through the market as they seek the most favorable investment approach.

Owning Physical Bullion

The decision to own or invest in physical bullion comes with a slew of considerations, including the current spot price to ensure a fair deal. For those drawn to tangible assets, the allure of holding gold and silver in their hands is undeniable. However, this route demands attention to secure storage solutions, whether opting for professional vault services like The VaultTM by The Royal Mint or devising an effective home storage system. Ensuring the safety of your investment with proper insurance coverage and maintaining an optimal environment to prevent damage is paramount.

With these considerations in mind, the investor must weigh the tangible satisfaction of physical bullion against the convenience and accessibility of bullion ETFs.

Bullion ETFs and Their Advantages

ETFs that specialize in bullion like SPDR Gold Shares and iShares Gold Trust give investors an easier way to delve into precious metals, as they mirror the market price movements of gold while offering lower fees and enhanced liquidity. These ETFs are actively traded on stock markets during regular trading hours, providing convenience unavailable with physical gold ownership. Though investing in these funds involves certain risks, such as fluctuations in gold prices and fund management expenses, they do circumvent issues related to physical security and disposal inherent to actual bullion.

The presence of bullion ETFs is increasingly influential in the investment landscape for gold, making them attractive for those wishing to gain exposure to precious metals without managing tangible assets. Individuals looking for more vigorous avenues can venture into futures trading, which adds another layer of dynamic possibilities within investments tied to precious metals.

Futures Contracts in the Bullion Market

Trading in futures contracts can be a powerful strategy for predicting future market prices of gold and silver, and they even offer the option to take physical possession of these precious metals. Actual delivery is usually not the goal for those engaging in speculation. The temptation lies in using leverage to amplify profits from a minimal initial outlay. Yet this approach also harbors risks, as it can lead to substantial losses if the market turns unfavorable. Investors need to adopt a specific mindset when delving into futures trading – which is facilitated by niche brokers that provide services for these types of transactions.

Considering such methods of investment, an insightful investor might then question how exactly are the prices set for bullion items like gold and silver? They would also delve into understanding what influences or alters their pricing mechanisms, in order to achieve comprehensive knowledge about valuation factors within this segment.

The Dynamics of Bullion Pricing

The intricate fluctuations in bullion metal prices are influenced by various elements, such as:

- The demand from manufacturers incorporating gold into their products

- How investors view the state of the economy

- The actions within bullion markets that establish fluctuating spot prices driven by industrial needs and investment activity

- Both jewelry and industrial applications also affect market rhythms through supply-demand interplay.

Several factors impact gold pricing, including:

- Gold’s tendency to move inversely to the U.S. dollar value, serving as a protection against inflationary trends

- Central bank activities regarding reserve diversification often raise gold values when they boost their holdings

-The perceived security of gold during times fraught with economic instability

These various components lead to shifts in how gold is priced on the market.

Grasping these mechanisms enables investors to base their decisions on sound knowledge, especially for securing reliable transactions involving investments.

Ensuring a Secure Bullion Transaction

Security in bullion transactions is paramount, and it starts with thorough research. Prospective investors should thoroughly vet potential dealers, verifying their credentials and reputation in the market. The modern landscape of gold certificates and pool programs presents an avenue for representing ownership in bullion, offering savings in various costs, but not without its own risks, such as the possibility of issuer insolvency.

Ensuring the integrity of the gold bar and its responsible sourcing is crucial for ethical and investment reasons, promoting a sustainable bullion market. Armed with knowledge and due diligence, investors can confidently navigate the bullion market, maximizing their returns with strategic trading.

Maximizing Returns: Strategies for Bullion Trading

Investors in the bullion market use various tactics to enhance their potential returns, including:

- Drawing trend lines that connect historical pricing data with the aim of forecasting future price trends

- Utilizing Fibonacci retracements to pinpoint likely points for initiating or closing positions

- Observing moving average crossovers as they can indicate a rising market and propose taking on long positions when shorter-term averages surpass longer-term ones

To optimize return on investment, it is vital for investors to time their sales carefully, considering factors such as economic climates, geopolitical incidents, and sentiment within the market. By integrating techniques like merging moving averages with Fibonacci retracements, traders are better positioned to make precise and effective trading decisions that could lead to more successful profitability outcomes.

In looking at the wider context of bullion trade operations, we acknowledge how instrumental the London Bullion Market Association is due to its profound influence on global gold prices and practices related directly or indirectly with investments in this sector.

The London Bullion Market Association: Its Impact and Influence

The London Bullion Market Association (LBMA) serves as a pivotal regulator in bullion commerce, upholding stringent standards for production quality and setting international price benchmarks for trades. Its Global Precious Metals Code advocates integrity within the market by promoting an environment that is robust, equitable, transparent and efficient.

Under the LBMA’s vigilant oversight, the London Bullion Market enables continuous trading activities, including spot transactions, forwards and options on precious metals. With its membership of mostly bullion banks, the LBMA exerts considerable influence across over-the-counter markets to shape how precious metals are traded worldwide.

In closing our examination of this topic, it’s important to pause briefly to contemplate what we’ve learned – not least among these insights being those associated with unique Ray ID – which has enriched our understanding of this key financial market institution responsible for shaping global trading in precious metals.

Summary

Our exploration has spanned from the lustrous bars of gold and silver to the intricate and fulfilling realm of bullion investments, enriching us with profound understanding. We have traversed both historical importance and present-day relevance of bullion, observed Lincoln Pawn’s expanding offerings, and examined various opportunities for investment enthusiasts. Our inquiry into the nuanced factors affecting bullion prices has revealed tactics for secure dealings that enhance potential profits.

As our paths diverge, let this compilation light your way toward triumphant endeavors in bullion investment. The domain of precious metals calls out to those equipped with knowledge and tactical mindset. Wishing you prosperity that mirrors the radiance of these treasured metals in all your future endeavors.

Frequently Asked Questions

What bullion means?

Bullion encompasses highly pure precious metals, such as gold and silver, valued strictly for their content of metal, rather than any artistic value from being shaped into coins or sold as decorative items. Typically preserved in the shape of ingots, bars, or coins, bullion represents a form of these metals that maintains considerable value.

What is the difference between gold and bullion?

Gold coins, which are minted as legal tender by sovereign government mints, typically have a higher quality of gold compared to gold bullion ingots that private mints produce. Bullion is frequently sold for investment purposes and may vary in karat, whereas the purity of gold in coins is usually greater.

Why is it illegal to own gold bullion?

Owning both gold bars and bullion in the United States is currently legal. The prohibition on private gold possession was a temporary measure implemented amid the Great Depression as an emergency action.

What is an example of bullion?

Bullion is typically available as bars, ingots, or coin forms, including popular options like the American Gold Eagle bars and American Silver Eagle coins produced by the United States Mint.

This term also encompasses physical silver and gold of high purity, commonly stored in shapes such as bars, coins, or ingots.

Is it better to buy gold or silver bullion?

Gold is regarded as a stronger diversification tool than silver, thus serving as a superior choice for diversifying one’s investment portfolio.